This article reviews and ranks the top budgeting apps of the year, focusing on features, accessibility, and most importantly cost. From the tried-and-true advice of financial gurus to the latest digital tools offering a variety of budgeting solutions, we delve into how specialized apps can support your financial goals. Whether you’re seeking comprehensive budgeting tools with detailed planning capabilities or simple apps that highlight smart savings loopholes, our guide will help you navigate the landscape of budgeting apps tailored to support prudent financial management without breaking the bank.

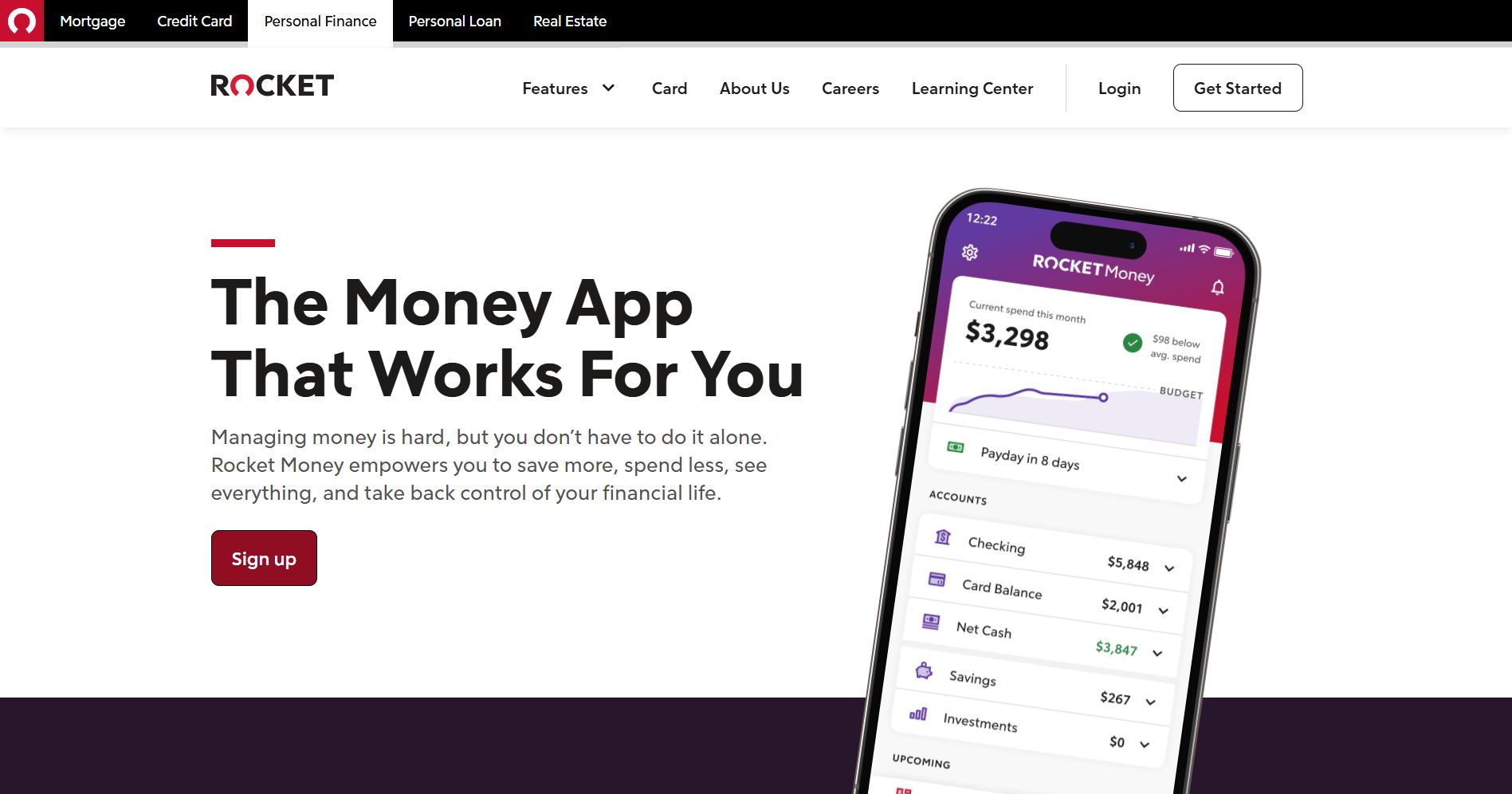

1. Rocket Money

Rocket Money offers a comprehensive suite of tools to manage finances effortlessly. It allows you to track your spending, categorize expenses, view upcoming bills, and utilize a bill negotiation service to lower your costs. The app also features automatic subscription cancellation, which helps manage and cancel unwanted subscriptions effectively.

Pros:

- Free basic service with optional premium features

- Bill negotiation and subscription cancellation services

- User-friendly interface across both mobile and web platforms

Cons:

- Premium features require a subscription

- Some services like bill negotiation take a fee from saved amounts

- Customer support is limited to premium users.

Rocket Money is highly rated on platforms like TrustPilot, with an outstanding rating from thousands of reviews. It is also accredited by the Better Business Bureau with a B rating.The basic version is completely free, offering robust features for most users’ budgeting needs. Although premium features, which include enhanced budget tracking, automatic savings, and exclusive customer support, are available for a monthly fee, the free version fully covers essential functions. Additionally, new premium members can explore these advanced features with a 7-day free trial before deciding to subscribe.

2. PocketGuard

PocketGuard simplifies budget management by syncing with your bank and credit accounts, providing a real-time overview of your finances. The app’s standout feature, “In My Pocket,” calculates how much money you have available after accounting for scheduled bills and savings goals, aiding in effective spending decisions.

Pros:

- Automatic transaction categorization enhances budget tracking.

- “In My Pocket” feature helps manage disposable income.

- Syncs with numerous financial institutions for comprehensive account management.

Cons:

- Limited functionality in the free version; features like custom categories and multiple savings goals are restricted to PocketGuard Plus.

PocketGuard users appreciate the app’s intuitive interface and effective budgeting tools, reflected in high ratings across app stores. However, some users desire more customization options, which are available in the Plus version. PocketGuard operates on a freemium model. The basic service is free and provides excellent tools for managing your budget effectively. For those looking for additional features, PocketGuard Plus is available for a monthly fee, an annual fee, or a lifetime access fee. Opting for an annual plan offers significant savings, making it a cost-effective choice. However, the free version is comprehensive enough to meet the needs of most users without any additional cost.

3. EveryDollar

EveryDollar is renowned for its simplicity and efficiency in budgeting, particularly with its zero-based budgeting method where every dollar is assigned a specific role, making it ideal for meticulous financial planning. The app allows for easy transaction entry and budget adjustments, ensuring users can manage their finances effectively without needing complex tools.

Pros:

- Offers a user-friendly interface that simplifies the budgeting process.

- Allows for extensive budget customization and includes reminders and financial advice through its Ramsey Pros section.

- Provides a free version that is adequate for basic budgeting needs.

Cons:

- Some advanced features, such as automatic transaction imports and account syncing, are only available in the paid version.

- The app does not facilitate direct management of investments or long-term financial planning.

EveryDollar generally receives positive feedback for its straightforward approach and effectiveness in budgeting. However, users have noted that the lack of investment tools and the cost of the premium version may not suit everyone’s needs.

EveryDollar provides a robust and completely free version for basic budgeting, which many users find more than sufficient for managing their finances effectively. The premium version, available for an annual fee after a 15-day free trial offers additional features like automatic transaction streaming and access to financial coaching sessions.

4. YNAB (You Need a Budget)

YNAB (You Need a Budget) differentiates itself by promoting a zero-based budgeting approach where every dollar is assigned a specific job, aiming to prevent wasteful spending and encourage savings. This method not only helps in managing monthly expenses but also in achieving financial goals by allocating funds towards debt repayment and savings. The app supports multiple devices and syncs data across all platforms, ensuring accessibility and consistency in budget tracking.

Pros:

- Supports detailed budgeting with customizable categories

- Syncs with over 12,000 banks to automatically import financial data

- Offers a 34-day free trial without requiring credit card details

Cons:

- Monthly subscription fee after the trial period

- Requires manual effort for transaction categorization and budget adjustments

- Limited customer support options, primarily via email

The app is highly regarded by its users, evidenced by its ratings on Trustpilot and similar high ratings on Google Play, reflecting its effectiveness in helping users manage their finances better.

YNAB offers an extensive 34-day free trial, allowing users ample time to explore its robust budgeting tools at no cost. Following the trial period, users can choose to continue with the paid subscription, which offers additional features for a monthly or annual fee. However, many users find the free trial period sufficient for their budgeting needs, making it a preferred choice.

5. Simplifi by Quicken

Simplifi by Quicken offers a user-friendly interface that allows you to connect all your financial accounts for a comprehensive overview. It provides a detailed dashboard that analyzes your spending and savings through innovative charts and data, making it one of the best budgeting and personal finance apps. The app’s standout feature, the Spending Plan, is highly innovative and unlike any other in the market, providing a dynamic way to manage your finances.

Pros:

- Simplifi offers robust transaction management tools, categorizing each transaction to help you track your spending effectively.

- The app includes a unique feature of Spending Watchlists that helps monitor specific spending areas, enhancing your budget control.

- It supports investment tracking, providing detailed insights into your portfolio’s performance.

Cons:

- Unlike some competitors, Simplifi does not offer traditional budget tools, which might be a limitation for users preferring specific spending limits.

- The app requires a subscription, with no free version available, which might be a barrier for some users.

The app is well-received with high ratings in the Apple Store and in the Google Play Store, indicating a generally positive user experience but highlighting some areas for improvement.

Simplifi operates on an annual subscription model, which is often discounted making it a cost-effective option for budgeting tools. They also provide special offers for new users, enhancing its accessibility for those with limited income.

These digital tools stand out as valuable allies in the quest for financial stability. Highlighting innovative features, user-friendly interfaces, and even opportunities for free or low-cost services, each app offers unique advantages tailored to support prudent financial management. This not only helps in organizing finances but also in identifying potential savings loopholes, thereby fostering a more secure financial future without necessitating significant investment.

Concluding, the choice of a budgeting app can fundamentally transform the way low-income households manage their finances, providing a pathway out of the maze of financial uncertainty to a clear plan for fiscal health. It’s clear these apps offer more than just budgeting assistance; they are a cornerstone for building a brighter financial tomorrow. As we continue to navigate the intricacies of personal finance, the significance of adopting a suitable budgeting tool cannot be overstated. Our promise is to help you find the best option possible, supporting your journey toward financial empowerment and stability.